Internal Revenue Service

Billions of federal dollars available for churches and nonprofits to go green

By Thomas Reese — July 20, 2023

(RNS) — Churches have a moral obligation to reduce their carbon footprint and to encourage climate justice for marginalized communities. If there is federal money to help in this effort, they should take advantage of it.

Playing chicken over debt and spending bills

By Thomas Reese — May 23, 2023

(RNS) — Would that Congress could look seriously at government programs to make them better and more efficient rather than grandstanding for the media and their partisan base.

How Congress can bring good news to the poor this Advent

By Jim Wallis — November 30, 2022

(RNS) — When something works to solve poverty the way the child tax credit has, it’s immoral to end it.

Religious right groups’ tax-status changes demean both church and state

By Jacob Lupfer — July 13, 2022

(RNS) — No honest person would call the political organization a church.

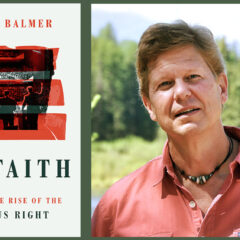

Randall Balmer on why racism, not abortion, birthed the religious right

By Yonat Shimron — September 22, 2021

(RNS) — In his new book, he shows it was government interference in ‘segregation academies’ such as Bob Jones University that sparked the growth of the religious right. Opposition to abortion was an afterthought.

Equity requires new taxes and the enforcement of current laws

By Thomas Reese — May 28, 2019

(RNS) — Tax avoidance is not a new topic for God's faithful: The Old Testament prophet Amos condemned the wealthy of his generation for the same tactics.

Clergy housing allowance is constitutional, appeals court rules

By Adelle M. Banks — March 19, 2019

(RNS) — The Freedom From Religion Foundation argued that the allowance gives ministers a religious benefit, but the court determined in a unanimous ruling that it did not overly entangle church and state.

Freedom from Religion Foundation group sues IRS over tax exemption

By Adelle M. Banks — October 11, 2018

(RNS) — In its complaint, the charity said it 'objects to having to file Form 990 while churches and church-related organizations do not.'

Churches are usually reluctant to push tax reform. But Catholic bishops are trying.

By Thomas Reese — November 3, 2017

WASHINGTON (RNS) — Churches are reluctant to get involved in tax reform because it is complicated and they fear the impact of reform on themselves and their donors. So it was surprising to see the U.S. Catholic bishops grapple with this controversial topic.

The ’Splainer: What is the Free Speech Fairness Act?

By Kimberly Winston — February 6, 2017

(RNS) Legislation introduced in Congress aims to 'restore' religious liberty in the pulpit. Will it? Let us 'Splain ...

IRS changes status of Billy Graham’s ministry

By Kimberly Winston — September 29, 2016

(RNS) The change means the 66-year-old ministry will not have to file a public document of its income and salaries.

Religious and secular advocates urge IRS to clarify rules on political endorsements from the pulpit

By Adelle M. Banks — January 29, 2015

WASHINGTON (RNS) Current IRS rules, dating to 1954, permit clergy to address issues but prohibit candidate endorsements. But those rules are routinely broken with little or no consequence.

IRS agrees to monitor churches for electioneering

By Kimberly Winston — July 21, 2014

(RNS) - Freedom From Religion Foundation has reached a settlement with the Internal Revenue Service over electioneering in churches, a violation of their tax-exempt status.

(UPDATED) Religious groups that claim they were IRS targets

By Adelle M. Banks — May 17, 2013

(RNS) The Internal Revenue Service, in the limelight this week after a watchdog panel said it used “inappropriate criteria” when considering applications for tax-exempt status by Tea Party groups, is also under fire from religious organizations.

Commission suggests ways to keep closer eye on lavish ministries

By Adelle M. Banks — December 5, 2012

(RNS) A special commission created by the Evangelical Council for Financial Accountability has called for clearer IRS guidance and greater involvement among donors to address “outliers” among congregations and other nonprofits that are not being financially accountable. By Adelle M. Banks.

Page 1 of 2